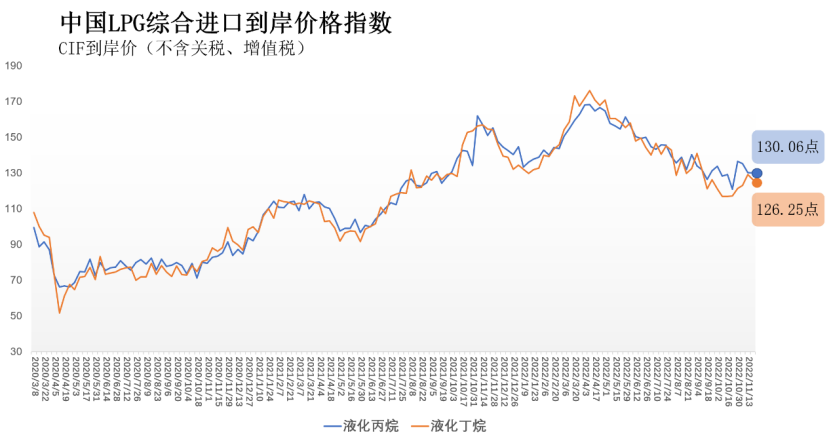

China's comprehensive import CIF price index of liquefied propane and butane

26 November 2022SHPGX Guidance: On November 23th, the China's comprehensive import CIF price index of liquefied petroleum gas (LPG) released by the Global Trade Monitoring and Analysis Center of the General Administration of Customs and the Shanghai Petroleum and Natural Gas Trading Center showed that from November 14th to 20th, China's comprehensive import CIF price index of liquefied propane was 130.06 points, down 0.12% month on month and 13.87% year on year; China's comprehensive CIF import price index of liquefied butane was 126.25 points, down 2.25% month on month and 18.33% year on year.

In terms of international pricing benchmark, according to the data released by CP of Saudi Aramco in November 2022, the propane contract price (CP) in November 2022 was 610 dollars/ton, an increase of 20 dollars/ton compared with the previous month, an increase of 3.39% month on month, and a decrease of 29.89% compared with the same period last year; The butane contract price (CP) in November was US $610/ton, an increase of US $50/ton compared with the previous month, an increase of 8.93% month on month and a decrease of 26.51% compared with the same period last year; In November, Saudi Arabia's CP stopped falling and turned up, rebounding from the lowest price level in recent year, which may boost the current domestic and foreign LPG market price level.

In terms of international price, the positive correlation between LPG international price and crude oil price is high. From the perspective of crude oil price, OPEC released the latest monthly crude oil market report last Monday, which lowered the global oil demand forecast for this year and next, and also warned about the uncertainty that the market will face. The epidemic situation in China, the world's largest oil importer, is continuing to heat up, and a number of economic data released recently are slightly lower than market expectations, which aggravates market concerns about crude oil demand.

Although the International Energy Agency (IEA) has previously raised the forecast of average daily oil demand growth this year, it is pessimistic about the expected data of average daily oil demand growth next year. Recently, geopolitical frictions continued to heat up, but soon afterwards NATO said that the missiles that caused explosions in Poland or came from Ukraine, effectively easing geopolitical tensions; At the same time, Russia resumed to transport oil to Hungary through the Druzhba pipeline, which eased the supply side's concern.

James Bullard, Chairman of the Federal Reserve in St. Louis, suggested that the Federal Reserve would raise interest rates by at least 150 basis points. He also said that the recent interest rate increase had limited impact on inflation; This statement may aggravate the market's concern about the sharp slowdown of the US economic growth in the coming quarters. In addition, according to the slightly lagging data released by the US Energy Information Administration (EIA) last Wednesday, the recent sharp drop in US commercial crude oil inventory far exceeded market expectations, which played a supporting role in crude oil prices.

However, due to negative factors occupying a strong dominant position in the current market, international oil prices fell sharply. As of last Friday, the settlement prices of the main contracts of WTI and Brent crude oil futures were 80.08 dollars/barrel and 87.62 dollars/barrel respectively, down 9.98% and 8.72% respectively from the previous week. The decline of international oil price is relatively large, which may further weaken the current domestic and foreign LPG market price level to a certain extent. Due to the trade process, the CIF price of LPG imports in China is often behind the futures price and spot price in the international market for a period of time. The impact of recent fluctuations in the price of LPG outside the market will gradually appear in the later CIF price of LPG imports.

In the domestic market, the supply side weakened slightly, the demand side maintained stability, and the market trading atmosphere was general. From the supply side, last week, the actual arrival of domestic imported LPG was less than expected, and the arrival resources were mainly concentrated in South China; The domestic gas volume mainly comes from local refineries, and the domestic LPG output in the week was basically flat compared with the previous week; On the whole, the total domestic LPG supply in the week decreased slightly compared with the previous week, and the supply side fundamentals were favorable. From the demand side, the peak season of civil gas consumption is coming, and the demand for civil fuel combustion is expected to increase; Industrial demand declined slightly. Specifically, in terms of chemical deep processing, in the field of propane deep processing, the operating rate of PDH unit continued to decline, and the demand for propane chemical industry decreased slightly; In the field of butane deep processing, the operating rates of MTBE and alkylation units rose and fell differently. The operating rates of MTBE units rose slightly month on month compared with the previous week, while the operating rates of alkylation units fell month on month compared with the previous week. The demand for butane chemical industry declined steadily. On the whole, the amount of resources arriving at Hong Kong last week was less than expected; The domestic gas volume was basically flat month on month compared with the previous week, and the overall market supply decreased slightly compared with the previous week; The peak consumption season of civil demand is coming, and the demand for civil fuel combustion is about to increase; Industrial demand continued to decline slightly, and the demand for propylene butane decreased to varying degrees. The prices of various products in the domestic liquefied gas industry chain fluctuated slightly last week, with both rising and falling.

The compilation of China's LPG comprehensive import CIF price index was jointly completed by the Global Trade Monitoring and Analysis Center of the General Administration of Customs and the Shanghai Oil and Gas Trading Center, Taking the first calendar week of 2019 as the base period (the comprehensive CIF import price of liquefied propane in China in the current week is 3541 yuan/ton, and the price index is 100; the comprehensive CIF import price of liquefied butane in China in the current week is 3535 yuan/ton, and the price index is 100), it comprehensively reflects the CIF import price level of LPG in China in the previous week. This is a beneficial exploration for China to compile its own LPG benchmark price, which is conducive to improving market transparency, providing an important reference for the marketization of LPG chemical industry, facilitating the timely and effective connection between the domestic market and the international market, and further enhancing China's influence on the international LPG market.